This report is the result of a large-scale field study on taxation in the artisanal mining sector in the eastern Congolese provinces of Ituri and South Kivu. The main finding is that current regulations and practices in the field not only cause mineral smuggling, which leaves some of the sector’s fiscal potential untapped at the provincial and national levels, but also constitute a source of insecurity and instability. The scope of the study and the level of detail at which it explores the subject are unparalleled to date and provide a wealth of insights, including workable recommendations to improve the current situation for all stakeholders.

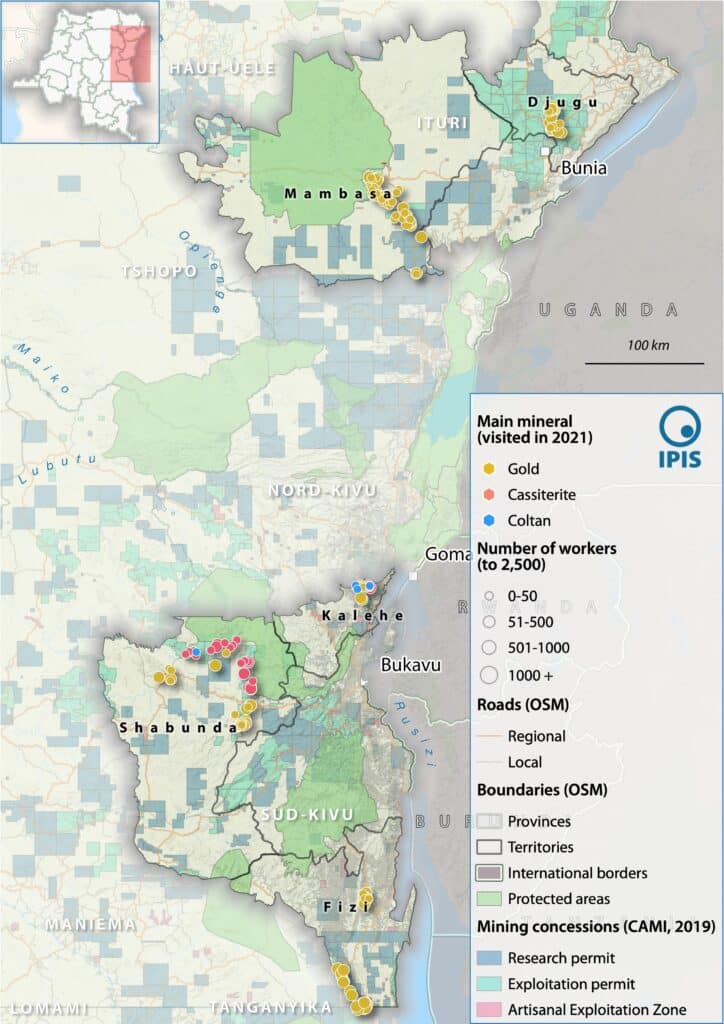

Surveyors trekked to 193 mining sites in June and November 2021 with detailed questionnaires. At 80 % of these sites, miners extracted gold while the other sites produced 3T minerals (tin, tungsten and tantalum). The main research questions were how much an artisanal miner pays to the government departments visiting their sites; what proportion of fees paid are legal vs illegal; how much do the fees bring in to government departments and the treasury; what parameters determine the level of taxation at sites; what are the payment modalities and how to improve them?

The surveyors found that 169 sites visited had paid at least one levy in the previous year. Among other things, the survey allowed the authors to conservatively estimate how much the 22,000 miners at those sites paid in levies during the period under review, namely US$ 2.441 million, or an average per miner of US$ 251 in Ituri and US$ 63 in South Kivu. It was also clear that large sites with many miners pay more taxes than smaller sites. In addition, more than 60% of the payments claimed are illegal, due to unclear regulations and a lack of transparency in their application, for example when it comes to determining the amount of a levy.

The authors argue that taxation should not take place at the level of production but a step further down the supply chain, at the level of middlemen and buying houses, by centralising levies and registration of production in one-stop shops. Further detailed recommendations concern a reduction of the tax burden on artisanal miners; harmonisation of taxes and a transparent application of regulations; providing guidance and support of miners as the key objective in the mission statement of the mining administration; a better functioning of the tax retribution to the provincial level and that of the ‘territoires’; a legislation on taxes for the use of explosive materials.

This research was conducted within the framework of the MADINI project. The MADINI project is funded by the Dutch Ministry of Foreign Affairs and aims to improve security, social cohesion and human rights in the conflict-ridden mineral-rich regions of eastern DRC.