In the global race for energy transition minerals that are meant to help address the climate change crisis, Zimbabwe is one of the few African countries with important lithium reserves. If mining projects are managed transparently and with respect for property rights, human rights and openness to competitive investments, it can potentially lead to growth and development that has so far eluded the country.

Recently, Chinese companies as well as local companies and artisanal miners have been rushing for lithium resources. The Zimbabwean government has responded with legislative changes and pronouncements. Especially the ban on the export of unbeneficiated or unprocessed lithium can be characterised as a knee-jerk reaction to the scramble for lithium through repeal and amendment of base mineral export laws.

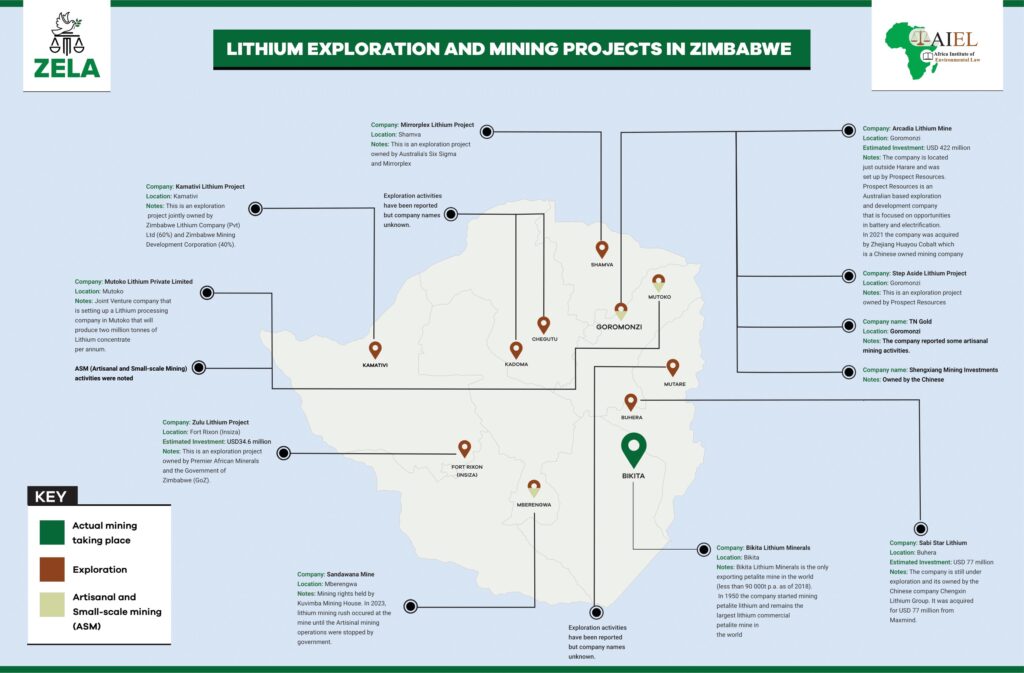

To date there are more than seven lithium exploration and mining projects at different development stages, with Chinese companies leading the race.

A recent report by the Zimbabwe Environmental Law Association (ZELA) revealed the potential risks and opportunities that exist, as well as the exclusion of community views and perspectives in discussions on energy transition, sustainability, technology development and climate change.

Largest reserves in Africa

Zimbabwe has the largest lithium reserves and mines in Africa, while globally the country ranks high amongst the leading lithium producing and supply countries after Chile, Australia, China, Argentina and Brazil. The exponential global demand for lithium is being driven by the rising production of electric vehicles – and other electronics – seen as essential for energy transition based on zero carbon emission.

Increased interest in Zimbabwe’s lithium has attracted an influx of prospective lithium mining investors, especially from China. To date there are more than seven lithium exploration and mining projects at different development stages, with Chinese companies leading the race. Zimbabwe therefore stands a better chance of coming clear with years of isolation, political tensions and economic turmoil if it manages to take advantage of its huge resource wealth to develop communities and the economy through transparent, accountable and responsible investment decisions.

China’s influence

According to a recent ZELA report, Chinese-owned companies have acquired the biggest portfolio of lithium mining projects in Zimbabwe. Some notable Chinese acquisitions include Arcadia Lithium Project acquired by Zhejiang Huayou Cobalt for US$ 422 million from Prospect Resources in 2021 and Bikita Lithium Mine acquired by Sinomine Resource Group (SRG). Besides acquisitions, Chinese investors Eagle Canyon International Group Holding Limited and Pacific Goal Investments have sealed a deal of US$13 billion with the Government for the construction of a ”mine to energy industrial park” to produce lithium-ion batteries. In March 2023, China Natural Resources entered into an agreement to acquire US-based Williams Minerals (Pvt) Ltd which owns lithium mining rights in Zimbabwe. While Zimbabwe needs these Chinese investments, it turns a blind eye to some of the governance factors that hinder Zimbabwe’s economic growth and benefits to communities due to poor safety standards, unsafe working condition, unfair displacement measures, environmental damage and low wages for the workers.

The Chinese strategy demonstrates no fear to seize the opportunities and occupying the risky investment space in Zimbabwe’s mining sector. Western investors on the other hand remain reluctant to work in Zimbabwe.

China’s aggressive approach in acquiring lithium mining projects matches Zimbabwe’s Look East Policy initiated by late President Mugabe which entails preferential trade relations with Asian countries, including China. With China’s growing mining, processing, refining and manufacturing capacity for energy minerals and EV batteries, Zimbabwe has become a major source market for raw materials alongside other Chinese lithium supply countries that include Chile, Argentina and Australia. Furthermore, the Chinese strategy demonstrates no fear to seize the opportunities and occupying the risky investment space in Zimbabwe’s mining sector. Western investors on the other hand remain reluctant to work in Zimbabwe and are concerned about the human rights situation. They fear sanctions, political uncertainty, security of investments and reputational risks. Recently the Australian investor of Zimbabwe’s lithium mines Prospect Resources sold its mining rights to a Chinese investor

Besides Chinese companies, Australian investors still run the Step Aside Lithium Project. The Government owns 65% of the shares of the Kuvimba Mining House that is exploring lithium at Sandawana Mine, while 35% is owned by private investors.

Artisanal lithium mining

Local communities and villagers in lithium rich areas of Zimbabwe are participating in lithium mining and trading activities, attracted by quick money and forced by limited (formal) job opportunities in the country. This is despite the illegality of artisanal mining in Zimbabwe. By November 2022, reports indicated that an estimated 5 000 artisanal miners, fortune seekers and foreigners were involved in mining and trading lithium at Sandawana Mine. Additionally, ZELA identified artisanal miners in Mutoko, Chiredzi, Goromonzi, Mberengwa and parts of Buhera districts. Artisanal miners use picks, hammers and shovels to dig and break lithium ore and load it onto wheelbarrows and trucks for export by Chinese, South African or Indian buyers. Challenges associated with artisanal lithium mining include limited access to clean water, lack of ablution facilities, environmental degradation and lack of personal protective equipment for the miners. Artisanally mined lithium is being sold at a pittance to Chinese buyers with prices ranging between $100-$150 per tonne. Moreover, smuggling and leakages of lithium across the border into South Africa or Mozambique were reported by various actors and media reports, raising the spectre of corruption, illicit mineral and financial flows.

Experience in other minerals such as gold in Zimbabwe and other African countries (DRC and Tanzania) has shown that artisanal mining in resource-rich areas has great development potential and criminalising it is counterproductive.

The artisanal sector is at present illegal and thus not regulated, yet the Government has been considering developing an Artisanal and Small-Scale Mining Policy. Experience in other minerals such as gold in Zimbabwe and other African countries (DRC and Tanzania) has shown that artisanal mining in resource-rich areas has great development potential and criminalising it is counterproductive. Regulated artisanal mining would benefit local community livelihood but it needs to be properly managed and implemented with the lessons learned from artisanal mining from other minerals and countries. An effective framework should have the right balance between regulating and supporting miners to collectively improve responsible mining practices, working conditions, environmental impact, and payment of taxes. The Government will also have to facilitate the development of infrastructure and human resource to ensure a transparent traceability of the newly artisanlly-mined lithium supply-chain.

Ban on export of unprocessed lithium and legal changes

Sudden economic and financial policy changes and inconsistencies affect the confidence of companies to make quick investment decisions in the country. Legal changes and reversals were evident when Government passed a law to ban the export of raw lithium through regulations1. Statutory Instrument 213 of 2022 and SI5 of 2023 banned the export of unprocessed or unbeneficiated raw lithium ore and base minerals, except under the written permission of the Minister. Statutory Instrument 213 of 2022 was repealed by SI 5 of 2023 which widened the export ban from focussing only on lithium to include other base minerals.

Zimbabwe’s challenge is whether it will be able to attract adequate capital and investment for processing and refining lithium into finished products such as batteries.

The ban on export of unprocessed base minerals has largely been viewed as part of efforts to promote value addition or beneficiation of minerals and to stop smuggling of raw lithium. Zimbabwe might have taken a cue from other African countries and Latin American countries that imposed bans on raw lithium exports and forced mines to process and refine lithium into concentrates before exporting to retain value of mineral wealth, boost tax revenue and encourage new local businesses and add jobs. However, Zimbabwe’s challenge is whether it will be able to attract adequate capital and investment for processing and refining lithium into finished products such as batteries. The ban has largely been viewed as a classic case of resource nationalism based on the need to promote domestic resource mobilisation.

Scope for responsible sourcing and promoting transparency

For Zimbabwe, transparency and accountability are important aspects that should be followed and applied in the lithium mining sector. In the same vein, encouraging companies to adopt responsible sourcing standards may help. ZELA also recommends opening up the sector to other investors to curb the Chinese monopoly which does not bring competition and value to exploiting the resource wealth. It is hoped that the Responsible Mining Audit instituted by Government in May 2023 will recommend company level practices and even government level legal and policy reforms that enhance responsible sourcing and mining standards. Developing a Critical Minerals Policy or Strategy may also help Zimbabwe make advances in benefiting from the lithium boom and energy transition phase, including giving indications on how companies and the state should design and implement responsible sourcing standards based on promotion of environmental, social and governance issues.

1. Base Minerals Export Control (Lithium Bearing Ores and Unbeneficiated Lithium) Order, 2022, Statutory Instrument 213/2022

Picture: Lithium ore in the hand of a woman. ©ZELA 2023

Further reading

Implications of the lithium mining rush in Zimbabwe: Analysis of legal developments | February 2023 | ZELA & AIEL

This situational report provides an account of the lithium rush in Zimbabwe by artisanal, small-scale and large-scale miners as well as the associated legal and policy developments. It also assesses the potential and actual impacts of lithium mining and exploration and provides insights and perspectives from local communities that should be considered in the wider discussion of energy transition, sustainability, technology development and climate change.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RH4CUMLZCFNHFE4A24HCPYL6WI.jpg)

China’s role in supplying critical minerals for the global transition: What could the future hold? | July 2022 | Leveraging transparency to reduce corruption (LTRC)

China Southern African and Extractive Industries | 2012 | Southern Africa Resource Watch

Why Look East? Zimbabwean Foreign Policy and China | 2007 | Jeremy Youde

All articles and other news items referenced in this briefing come from third party media sources. Not being the author, IPIS is not responsible for the content of the news items or articles contained or referred to in this briefing.

This briefing was produced with the financial assistance of the European Union. The contents of the editorial is the sole responsibility of IPIS and can under no circumstances be regarded as reflecting the position of the European Union.